Mobile money for financial inclusion?

Mobile money for financial inclusion?

Nora Lindstrom, Lilongwe Community Manager

Leapfrogging technologies is nothing new in developing countries, with novel opportunities offered by the mobile phone epitomising the phenomenon. In Malawi, where only around a quarter of the population is estimated to be formally banked, residents have over the past couple of years gained access to mobile money services, even on the most basic Nokia brick.

Theoretically, mobile money services offer many opportunities for the unbanked urban poor. The new services enable urban dwellers to handle money more securely, pay for goods and services, as well as send money home to relatives in the countryside. When Airtel Money launched in 2012 as the first mobile money service in the country, the then Minister of Finance Ken Lipenga hailed it as a way for both banked and unbanked customers to "enjoy the benefits of affordable, fast, and secure financial transactions."

Theoretically, mobile money services offer many opportunities for the unbanked urban poor. The new services enable urban dwellers to handle money more securely, pay for goods and services, as well as send money home to relatives in the countryside. When Airtel Money launched in 2012 as the first mobile money service in the country, the then Minister of Finance Ken Lipenga hailed it as a way for both banked and unbanked customers to "enjoy the benefits of affordable, fast, and secure financial transactions."

According to recent reports, Airtel now has over 700,000 mobile money customers. Rival telecom TNM has also entered the sector, launching Mpamba Mobile Money Service in 2013. Nevertheless, introducing the service to Malawi has not been without its challenges: it is estimated that only around 10 percent of mobile phone users in Malawi currently have mobile money accounts. And there are reasons for that.

When Lilongwe resident Yusuf Meya earlier this year wanted to send money to his sick mother in the countryside, he chose to send it through the Post Office, paying 10 percent of the sum wired in transfer fees. This wasn't a decision he made due to ignorance of mobile money or lack of access to a mobile phone. He simply had no other choice: in his mother's village there are no reliable mobile money agents from which his mother could claim the cash. "I needed to make sure that my mother received the money the same day," Meya says. "If I had used mobile money, it might have taken her three days to get access to the cash, because the agent might not have had the money immediately."

When Lilongwe resident Yusuf Meya earlier this year wanted to send money to his sick mother in the countryside, he chose to send it through the Post Office, paying 10 percent of the sum wired in transfer fees. This wasn't a decision he made due to ignorance of mobile money or lack of access to a mobile phone. He simply had no other choice: in his mother's village there are no reliable mobile money agents from which his mother could claim the cash. "I needed to make sure that my mother received the money the same day," Meya says. "If I had used mobile money, it might have taken her three days to get access to the cash, because the agent might not have had the money immediately."

This problem, known as agent illiquidity, is a recognised challenge in Malawi. So while mobile money could offer an inexpensive means for higher earning urban residents to send money to their rural relatives, lack of extensive agent networks with liquidity is holding them back.

Another use of mobile money promoted by the two companies is to pay for goods and services. Both Airtel and TNM's services allow customers to pay their utility bills using mobile money, and TNM has partnered with more than 1000 commercial businesses, including satellite TV company DSTv, 'luxury' bus service provider AXA, and fast-food chains Steers and Debonairs.

Again, however, the services offered fail to provide widespread benefits to the urban poor; few of the urban poor have direct utility connections, and even fewer are likely to fork out 4000 Malawi kwacha (around US$10) for a Debonair's pizza.

Two years on and mobile money has failed to make major inroads among Malawians. Even the urban poor have been slow on the uptake, despite having significantly better access to mobile money agents with liquidity (as well as access to a higher amount of agents more generally) and more use for the payment options offered compared to their rural counterparts.

The opportunities offered by mobile money however remain. Ongoing advertising campaigns by both Airtel and TNM highlighting the financial ease and security of mobile money combined with improvements in accessibility, such as Airtel's recently announced partnership with Total petrol stations, could over the next few years lead to wider use. Still, in a traditionally cash-reliant society convincing people to go mobile with their money is going to remain a challenge. Close.

Permalink to this discussion: http://urb.im/c1412

Permalink to this post: http://urb.im/ca1412lle

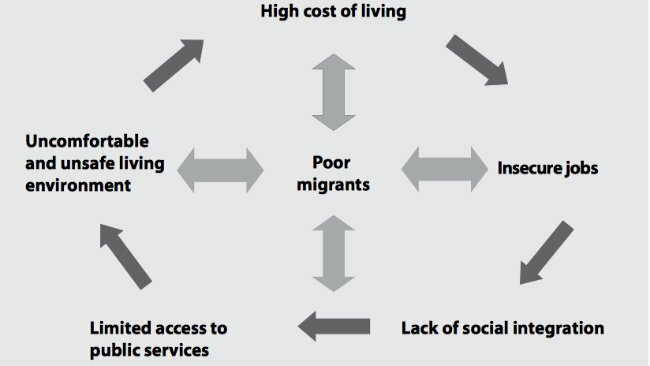

December 2014 — Urban equity, financial inclusion, and the alleviation or elimination of urban poverty all demand that the gaps between formal and informal communities and economies be bridged. To address these needs, initiatives have sprung up in cities throughout the developing world that aim to put financial power and momentum into the hands of poor and disenfranchised residents of informal urban communities, while strengthening the power of cities to put inclusive principles into practice. Some target financial literacy and the ability to navigate the formal economy; some use micro-finance loans and other financial instruments to empower those outside the conventional definition of creditworthiness; others use mobile money and other technologies to bridge access gaps.

December 2014 — Urban equity, financial inclusion, and the alleviation or elimination of urban poverty all demand that the gaps between formal and informal communities and economies be bridged. To address these needs, initiatives have sprung up in cities throughout the developing world that aim to put financial power and momentum into the hands of poor and disenfranchised residents of informal urban communities, while strengthening the power of cities to put inclusive principles into practice. Some target financial literacy and the ability to navigate the formal economy; some use micro-finance loans and other financial instruments to empower those outside the conventional definition of creditworthiness; others use mobile money and other technologies to bridge access gaps.

Jozi@Work: Co-production between Citizen and City

Jozi@Work: Co-production between Citizen and City Specifically, by the close of the current mayoral term in 2016, Jozi@Work plans to allocate over R1 billion (US$100 million) or seven percent of the City's total budget in City contracting (made up of ten percent of all City contracted services, ten percent of repairs and maintenance, and five percent of all capital spend) to an estimated 1,750 new and existing community-level co-operatives and enterprises. This, it claims, will support 12,500 livelihoods over the next year and create 40,000 new jobs by 2016, and thereby make a significant change in poverty, inequality, and unemployment realities in the city. Another aspect in which it also hopes to effect change is in maintaining and improving service standards and quality across often sharply contrasting neighborhoods and communities.

Specifically, by the close of the current mayoral term in 2016, Jozi@Work plans to allocate over R1 billion (US$100 million) or seven percent of the City's total budget in City contracting (made up of ten percent of all City contracted services, ten percent of repairs and maintenance, and five percent of all capital spend) to an estimated 1,750 new and existing community-level co-operatives and enterprises. This, it claims, will support 12,500 livelihoods over the next year and create 40,000 new jobs by 2016, and thereby make a significant change in poverty, inequality, and unemployment realities in the city. Another aspect in which it also hopes to effect change is in maintaining and improving service standards and quality across often sharply contrasting neighborhoods and communities.

چگونه سیاست مالی غلط یک طرح را به ضد خودش تبدیل می¬کند.

چگونه سیاست مالی غلط یک طرح را به ضد خودش تبدیل می¬کند.

Empoderando a las PyMES informales a través de educación financiera

Empoderando a las PyMES informales a través de educación financiera La exclusión financiera afecta a personas físicas con actividad empresarial, así como a Pequeñas y Medianas Empresas (PyMES). Con respecto a las PyMES en el sector informal, el impacto negativo es mayor pues los emprendedores normalmente tienen dificultad para encontrar financiamiento para sus negocios, crédito al consumo, seguridad social para sus empleados, acceso a formación de instituciones aliadas, entre otros beneficios.

La exclusión financiera afecta a personas físicas con actividad empresarial, así como a Pequeñas y Medianas Empresas (PyMES). Con respecto a las PyMES en el sector informal, el impacto negativo es mayor pues los emprendedores normalmente tienen dificultad para encontrar financiamiento para sus negocios, crédito al consumo, seguridad social para sus empleados, acceso a formación de instituciones aliadas, entre otros beneficios.

Menuju keuangan inklusif melalui pendidikan keuangan

Menuju keuangan inklusif melalui pendidikan keuangan Salah satu program pendidikan keuangan (financial education) adalah kampanye AYO KE BANK dan peluncuran produk TabunganKu. Program ini memberi kesempatan pada masyarakat yang selama ini tidak terjangkau oleh sektor keuangan formal untuk dapat mengakses jasa perbankan termasuk produk bank yang paling dasar seperti tabungan, pinjaman, transfer, serta asuransi dengan harga yang terjangkau. Dalam skema ini, mereka yang tertarik untuk menabung tidak dikenai biaya bulanan dan tabungan awal atau deposit yang rendah. Dengan demikian diharapkan akan lebih banyak orang mulai menabung maupun memakai jasa keuangan lainnya.

Salah satu program pendidikan keuangan (financial education) adalah kampanye AYO KE BANK dan peluncuran produk TabunganKu. Program ini memberi kesempatan pada masyarakat yang selama ini tidak terjangkau oleh sektor keuangan formal untuk dapat mengakses jasa perbankan termasuk produk bank yang paling dasar seperti tabungan, pinjaman, transfer, serta asuransi dengan harga yang terjangkau. Dalam skema ini, mereka yang tertarik untuk menabung tidak dikenai biaya bulanan dan tabungan awal atau deposit yang rendah. Dengan demikian diharapkan akan lebih banyak orang mulai menabung maupun memakai jasa keuangan lainnya.

Expanding skills-training access through microloans

Expanding skills-training access through microloans EduBridge, based in Mumbai, is one of these organizations working to close the skills gap. The training center helps underprivileged youth develop the skills to work with corporate India in the future. It has received accolades for being one of the NSDC's most successful investees. While the tuition fees are usually not outrageous for programs such as these, they can still be out of reach for many youths. The Times of India reports that on average a three-month program costs between INR 8,000 and INR 30,000 (USD $130-$480). However, as the push to improve the quality of training courses continues, associated costs are likely to go up, further expanding the gap in ability to pay.

EduBridge, based in Mumbai, is one of these organizations working to close the skills gap. The training center helps underprivileged youth develop the skills to work with corporate India in the future. It has received accolades for being one of the NSDC's most successful investees. While the tuition fees are usually not outrageous for programs such as these, they can still be out of reach for many youths. The Times of India reports that on average a three-month program costs between INR 8,000 and INR 30,000 (USD $130-$480). However, as the push to improve the quality of training courses continues, associated costs are likely to go up, further expanding the gap in ability to pay.

Combatiendo la pobreza y la desigualdad de género mediante la inclusión financiera

Combatiendo la pobreza y la desigualdad de género mediante la inclusión financiera El Banco WWB inició sus operaciones en 1980, como una fundación creada por 69 mujeres de Cali. Su primer crédito lo otorgó a una mujer que abrió una tienda de bicicletas, que aún hoy en día sigue funcionando. En un principio recibieron el apoyo de organizaciones privadas, como la Fundación Carvajal, y posteriormente de organizaciones internacionales y el apoyo técnico de multilaterales como el Banco Interamericano de Desarrollo. En el año 2011 se constituyó formalmente como un banco. Sus clientes son principalmente microempresarios, y un 60 por ciento siguen siendo mujeres. Tiene en la actualidad captados $260 mil millones en CDT y $33 mil millones en 140 mil cuentas de ahorro.

El Banco WWB inició sus operaciones en 1980, como una fundación creada por 69 mujeres de Cali. Su primer crédito lo otorgó a una mujer que abrió una tienda de bicicletas, que aún hoy en día sigue funcionando. En un principio recibieron el apoyo de organizaciones privadas, como la Fundación Carvajal, y posteriormente de organizaciones internacionales y el apoyo técnico de multilaterales como el Banco Interamericano de Desarrollo. En el año 2011 se constituyó formalmente como un banco. Sus clientes son principalmente microempresarios, y un 60 por ciento siguen siendo mujeres. Tiene en la actualidad captados $260 mil millones en CDT y $33 mil millones en 140 mil cuentas de ahorro. En

En

Linking social protection for financial equity in Tanzania

Linking social protection for financial equity in Tanzania The Tanzania Social Action Fund (TASAF) is a national intervention providing a safety net to the poor, while also providing sustainable income growth. It provides finances for Tanzania's 13.5 million people living below the poverty line. Its Productive Social Safety Net (PSSN), in collaboration with the World Bank, involves the poor contributing into three "funds," which enable them to afford basic necessities — food, health, and education for their children. For example, one of the funds is a Community Health Fund, whereby the individual or family pays a determined regular fee, which contributes to the health care of the household in the event it is required. The household is entered into a savings scheme, which protects their assets for when emergencies arise. PSSN is an unconditional transfer system that has had a positive impact on 280,000 poor beneficiaries. These households are now able to live with the security and protection of assets.

The Tanzania Social Action Fund (TASAF) is a national intervention providing a safety net to the poor, while also providing sustainable income growth. It provides finances for Tanzania's 13.5 million people living below the poverty line. Its Productive Social Safety Net (PSSN), in collaboration with the World Bank, involves the poor contributing into three "funds," which enable them to afford basic necessities — food, health, and education for their children. For example, one of the funds is a Community Health Fund, whereby the individual or family pays a determined regular fee, which contributes to the health care of the household in the event it is required. The household is entered into a savings scheme, which protects their assets for when emergencies arise. PSSN is an unconditional transfer system that has had a positive impact on 280,000 poor beneficiaries. These households are now able to live with the security and protection of assets.

সামাজিক শ্রেণীর মধ্যকার যোগসূত্রঃ বিকাশ ওয়ালেট

সামাজিক শ্রেণীর মধ্যকার যোগসূত্রঃ বিকাশ ওয়ালেট বিকাশ ওয়ালেটে ন্যূনতম ১০০০ টাকা এবং এর উপরে যে কোন পরিমাণ রাখা যায়। সদস্যবৃন্দ স্থানীয় বিকাশ কেন্দ্রে একটি ফর্ম পূরণ করে, যেখানে তারা তাদের যে মোবাইল নম্বর বিকাশ ওয়ালেট বা অন্যান্য ব্যবহারের জন্য ব্যবহার করবে তা প্রদান করে, এবং সাক্ষর-স্বরূপ বৃদ্ধাঙ্গুলের ছাপ দেয়। গ্রাহকরা তারপর তাদের ওয়ালেটে যে পরিমাণ হস্তান্তর করতে ইচ্ছুক সে পরিমাণ অর্থ এজেন্টকে দেয়। এই পরিমাণ অবিলম্বে তাদের অ্যাকাউন্টে যুক্ত হয় এবং তারা দেশব্যাপী যে কোনো স্থান থেকে এটিএম এর মাধ্যমে বা অন্য বিকাশ এজেন্টের সাহায্যে টাকা উত্তোলন করতে পারেন। পাশাপাশি, তারা বিকাশের সাথে যুক্ত যে কোনো পরিসেবা গ্রহণের সময় বিকাশ ওয়ালেট ব্যবহার করতে পারেন। এছাড়া, তারা তাদের মোবাইল নম্বর সহ প্রাসঙ্গিক কোড ডায়ালের মাধ্যমে ফোন ক্রেডিট রিফিল এবং অর্থ স্থানান্তর করতে পারেন।

বিকাশ ওয়ালেটে ন্যূনতম ১০০০ টাকা এবং এর উপরে যে কোন পরিমাণ রাখা যায়। সদস্যবৃন্দ স্থানীয় বিকাশ কেন্দ্রে একটি ফর্ম পূরণ করে, যেখানে তারা তাদের যে মোবাইল নম্বর বিকাশ ওয়ালেট বা অন্যান্য ব্যবহারের জন্য ব্যবহার করবে তা প্রদান করে, এবং সাক্ষর-স্বরূপ বৃদ্ধাঙ্গুলের ছাপ দেয়। গ্রাহকরা তারপর তাদের ওয়ালেটে যে পরিমাণ হস্তান্তর করতে ইচ্ছুক সে পরিমাণ অর্থ এজেন্টকে দেয়। এই পরিমাণ অবিলম্বে তাদের অ্যাকাউন্টে যুক্ত হয় এবং তারা দেশব্যাপী যে কোনো স্থান থেকে এটিএম এর মাধ্যমে বা অন্য বিকাশ এজেন্টের সাহায্যে টাকা উত্তোলন করতে পারেন। পাশাপাশি, তারা বিকাশের সাথে যুক্ত যে কোনো পরিসেবা গ্রহণের সময় বিকাশ ওয়ালেট ব্যবহার করতে পারেন। এছাড়া, তারা তাদের মোবাইল নম্বর সহ প্রাসঙ্গিক কোড ডায়ালের মাধ্যমে ফোন ক্রেডিট রিফিল এবং অর্থ স্থানান্তর করতে পারেন।

Multiple financial solutions for multidimensional poverty

Multiple financial solutions for multidimensional poverty According to the 2009-2013 survey of the Mekong Development Research Institute (MDRI), 51 percent of the poor in HCMC had received approval from one of the different micro-finance funds, and many of them felt very positive about the simple procedures and quick results of these organizations. "Previously I was funded 5 million (USD $234), and was able to repay after one year. At the end of 2011, my daughter-in-law wanted to open a small grocery stall at home. I went to the office and was instructed by the staff of the Social Policies Bank. The procedures were really simple," said one participant in a group interview of the MDRI survey.

According to the 2009-2013 survey of the Mekong Development Research Institute (MDRI), 51 percent of the poor in HCMC had received approval from one of the different micro-finance funds, and many of them felt very positive about the simple procedures and quick results of these organizations. "Previously I was funded 5 million (USD $234), and was able to repay after one year. At the end of 2011, my daughter-in-law wanted to open a small grocery stall at home. I went to the office and was instructed by the staff of the Social Policies Bank. The procedures were really simple," said one participant in a group interview of the MDRI survey. On the more negative side, these various funds have been working toward only one target: the poverty line; and only one homogeneous group of customers: the poor. They have been pouring all the resources in without finely segmenting their specific customers. This issue has led to stories such as the one told in the MDRI group interview: "My daughter had only finished the 2nd grade. Our family wants her to go to vocational training, but the funds require at least a secondary school diploma. How can she go?" The family was not eligible for the vocational training funds, but could have been the right customer for the education fund. However, the education fund did not communicate its availability as well as the importance of literacy education before vocational education to its correct target, because of their unspecified metrics and ineffective methodology.

On the more negative side, these various funds have been working toward only one target: the poverty line; and only one homogeneous group of customers: the poor. They have been pouring all the resources in without finely segmenting their specific customers. This issue has led to stories such as the one told in the MDRI group interview: "My daughter had only finished the 2nd grade. Our family wants her to go to vocational training, but the funds require at least a secondary school diploma. How can she go?" The family was not eligible for the vocational training funds, but could have been the right customer for the education fund. However, the education fund did not communicate its availability as well as the importance of literacy education before vocational education to its correct target, because of their unspecified metrics and ineffective methodology. In South Africa, the microfinance sector has grown over the last decade with 41 percent of an estimated 421,000 informal credit unions or savings groups ("stokvels") now in the formal economy. Again, however, much of the loans are not used for growing small enterprises but for consumption. Set against the contentious reality of the global microfinance industry, and a local context of high household debt, rising cost of living, and high unemployment, South Africans appear to need better ways to build and maximize savings more than they need new ways to incur debt. South African microfinance—which looks set to continue its growth—must therefore consider how it might grow differently, with success defined not by high loan repayment rates but by whether loans actually transform lives.

In South Africa, the microfinance sector has grown over the last decade with 41 percent of an estimated 421,000 informal credit unions or savings groups ("stokvels") now in the formal economy. Again, however, much of the loans are not used for growing small enterprises but for consumption. Set against the contentious reality of the global microfinance industry, and a local context of high household debt, rising cost of living, and high unemployment, South Africans appear to need better ways to build and maximize savings more than they need new ways to incur debt. South African microfinance—which looks set to continue its growth—must therefore consider how it might grow differently, with success defined not by high loan repayment rates but by whether loans actually transform lives. In another approach, the sector could be more attentive to the context in which impact is desired and link up with other projects and actors. Other City projects, for example, could provide city infrastructure while formal and informal financial institutions and structures can 'clip' onto these catalytic projects. South Africa's

In another approach, the sector could be more attentive to the context in which impact is desired and link up with other projects and actors. Other City projects, for example, could provide city infrastructure while formal and informal financial institutions and structures can 'clip' onto these catalytic projects. South Africa's  Jumlah pekerja sektor informal Jakarta mencapai lebih dari 1,5 juta orang. Para pedagang kecil ini kerap memenuhi sudut Jakarta dan dihadapkan pada kesulitan memperoleh modal. Bantuan untuk pengembangan usaha mereka juga minim. Keberadaan Ruma merupakan angin segar bagi para pemilik usaha kecil ini. PT Ruma merupakan lembaga usaha bermisi sosial (social enterprise) yang memberikan bantuan modal, bimbingan dan pelatihan bagi pengusahan mikro sehingga mereka bisa mengakses layanan keuangan dan informasi dengan memberdayakan toko dan warung milik perorangan melalui teknologi yang mudah digunakan semua orang.

Jumlah pekerja sektor informal Jakarta mencapai lebih dari 1,5 juta orang. Para pedagang kecil ini kerap memenuhi sudut Jakarta dan dihadapkan pada kesulitan memperoleh modal. Bantuan untuk pengembangan usaha mereka juga minim. Keberadaan Ruma merupakan angin segar bagi para pemilik usaha kecil ini. PT Ruma merupakan lembaga usaha bermisi sosial (social enterprise) yang memberikan bantuan modal, bimbingan dan pelatihan bagi pengusahan mikro sehingga mereka bisa mengakses layanan keuangan dan informasi dengan memberdayakan toko dan warung milik perorangan melalui teknologi yang mudah digunakan semua orang.

Mobile money for financial inclusion?

Mobile money for financial inclusion? Theoretically, mobile money services offer many opportunities for the unbanked urban poor. The new services enable urban dwellers to handle money more securely, pay for goods and services, as well as send money home to relatives in the countryside. When Airtel Money launched in 2012 as the first mobile money service in the country, the then Minister of Finance Ken Lipenga hailed it as a way for both banked and unbanked customers to "enjoy the benefits of affordable, fast, and secure financial transactions."

Theoretically, mobile money services offer many opportunities for the unbanked urban poor. The new services enable urban dwellers to handle money more securely, pay for goods and services, as well as send money home to relatives in the countryside. When Airtel Money launched in 2012 as the first mobile money service in the country, the then Minister of Finance Ken Lipenga hailed it as a way for both banked and unbanked customers to "enjoy the benefits of affordable, fast, and secure financial transactions." When Lilongwe resident Yusuf Meya earlier this year wanted to send money to his sick mother in the countryside, he chose to send it through the Post Office, paying 10 percent of the sum wired in transfer fees. This wasn't a decision he made due to ignorance of mobile money or lack of access to a mobile phone. He simply had no other choice: in his mother's village there are no reliable mobile money agents from which his mother could claim the cash. "I needed to make sure that my mother received the money the same day," Meya says. "If I had used mobile money, it might have taken her three days to get access to the cash, because the agent might not have had the money immediately."

When Lilongwe resident Yusuf Meya earlier this year wanted to send money to his sick mother in the countryside, he chose to send it through the Post Office, paying 10 percent of the sum wired in transfer fees. This wasn't a decision he made due to ignorance of mobile money or lack of access to a mobile phone. He simply had no other choice: in his mother's village there are no reliable mobile money agents from which his mother could claim the cash. "I needed to make sure that my mother received the money the same day," Meya says. "If I had used mobile money, it might have taken her three days to get access to the cash, because the agent might not have had the money immediately." Bangalore-based Parinaam is working to address this gaping need. Founded by Elaine Ghosh in 2006, the organization works in eight slums, which house the city's most needy. They are the working poor — rickshaw drivers, street cleaners, vegetable sellers — who not only lack access to formal banking systems, but lack access to most other services as well. These extreme conditions make them vulnerable to malnutrition, disease, and very casual work conditions. They live on the edge with little opportunity to save, and the programs that have worked for other poor communities have hardly been experimented with among this population. "Despite the success of microfinance and other development initiatives, the bottom 5% of the poor are continually excluded," says Parinaam. The organization is working to change this.

Bangalore-based Parinaam is working to address this gaping need. Founded by Elaine Ghosh in 2006, the organization works in eight slums, which house the city's most needy. They are the working poor — rickshaw drivers, street cleaners, vegetable sellers — who not only lack access to formal banking systems, but lack access to most other services as well. These extreme conditions make them vulnerable to malnutrition, disease, and very casual work conditions. They live on the edge with little opportunity to save, and the programs that have worked for other poor communities have hardly been experimented with among this population. "Despite the success of microfinance and other development initiatives, the bottom 5% of the poor are continually excluded," says Parinaam. The organization is working to change this.

Banking the unbanked and the underbanked

Banking the unbanked and the underbanked Most efforts at including the poor revolve around policies requiring commercial banking institutions to revamp their account opening policies and expand their reach. These requests have been met with various responses from the different commercial banks including increased branch openings, 'no minimum balance' account options, mobile money programs, and point of sale terminals (PoS) to mention a few. While these efforts contribute to inclusion, the major barriers to inclusion — lengthy time requirements for both account opening/maintenance and credit approval — are not thoroughly addressed. However, one bank stands out with its agent banking program: the Sterling Bank.

Most efforts at including the poor revolve around policies requiring commercial banking institutions to revamp their account opening policies and expand their reach. These requests have been met with various responses from the different commercial banks including increased branch openings, 'no minimum balance' account options, mobile money programs, and point of sale terminals (PoS) to mention a few. While these efforts contribute to inclusion, the major barriers to inclusion — lengthy time requirements for both account opening/maintenance and credit approval — are not thoroughly addressed. However, one bank stands out with its agent banking program: the Sterling Bank.

Innovation in financial services and financial literacy training for Nairobi residents

Innovation in financial services and financial literacy training for Nairobi residents Safaricom and Vodaphone revolutionized banking for Kenyans in 2007 with the introduction of M-Pesa. For the first time, highly impoverished individuals who were previously unable to access formal banking, were able to deposit money to an account. The services available to M-Pesa users took another leap forward in 2012 with the introduction of M-Shwari.

Safaricom and Vodaphone revolutionized banking for Kenyans in 2007 with the introduction of M-Pesa. For the first time, highly impoverished individuals who were previously unable to access formal banking, were able to deposit money to an account. The services available to M-Pesa users took another leap forward in 2012 with the introduction of M-Shwari.

تسهيلات التمويل الإسكاني: تجربة بنك ناصر الاجتماعي في مصر

تسهيلات التمويل الإسكاني: تجربة بنك ناصر الاجتماعي في مصر

Financial Inclusion = Participation + Access

Financial Inclusion = Participation + Access Among Delhi's poor, financial literacy skills are still lacking. For example, large numbers of boys and girls who run away from their homes in villages come to the city for survival and don't have any support mechanisms. They work in the informal sector to earn minimal wage and usually spend it on unhealthy items such as tobacco, alcohol, and drugs. One particular NGO, Sanchayan Society, is dedicated to disseminating financial literacy among youth, urban migrants, and the rural population. It conducts sessions on the importance of saving money for their future, the basics of banking, how to obtain financial identity like PAN cards, and developing entrepreneurship skills. The workshops are designed in a practical manner, comprised of games and activities such that these underprivileged youth can understand money and improve their "financial happiness." There are other initiatives being undertaken by the Reserve Bank of India and the Securities and Exchange Board of India. In addition, many institutions — including Swadhaar FinAccess, Jana Urban Foundation, Samhita Community Development Services, the Parinaam Foundation and Ujjivan Financial Services — are working on pilot models of financial sustainability to address this gap.

Among Delhi's poor, financial literacy skills are still lacking. For example, large numbers of boys and girls who run away from their homes in villages come to the city for survival and don't have any support mechanisms. They work in the informal sector to earn minimal wage and usually spend it on unhealthy items such as tobacco, alcohol, and drugs. One particular NGO, Sanchayan Society, is dedicated to disseminating financial literacy among youth, urban migrants, and the rural population. It conducts sessions on the importance of saving money for their future, the basics of banking, how to obtain financial identity like PAN cards, and developing entrepreneurship skills. The workshops are designed in a practical manner, comprised of games and activities such that these underprivileged youth can understand money and improve their "financial happiness." There are other initiatives being undertaken by the Reserve Bank of India and the Securities and Exchange Board of India. In addition, many institutions — including Swadhaar FinAccess, Jana Urban Foundation, Samhita Community Development Services, the Parinaam Foundation and Ujjivan Financial Services — are working on pilot models of financial sustainability to address this gap. Para acelerar el proceso de bancarización, y mejorar de esta forma los niveles de inclusión financiera, acaba de entrar en vigor la ley que recibe precisamente el nombre de Ley de Inclusión Financiera. Aunque por su nombre pudiera parecer que tiene un alcance mucho mayor, su principal aportación es la creación de las Sociedades Especializadas en Depósitos y Pagos Electrónicos (Sedpe). Estas entidades tendrán autorizada la captación de recursos, aunque no podrán conceder créditos. Sus principales servicios serán la realización de giros, pagos y transferencias. Podrán emitir tarjetas de débito. Las principales novedades de estas entidades serán una necesidad de capital muy inferior a la necesaria para abrir un banco (tan solo el equivalente a unos 2,7 millones de US$), y que quedan exentos del pago del 4 por mil al que están sujetas las entidades financieras tradicionales. Los depósitos estarán garantizados por Fondo de Garantías de Instituciones Financieras (Fogafín). La apertura de cuentas se podrá hacer con apenas tres datos básicos.

Para acelerar el proceso de bancarización, y mejorar de esta forma los niveles de inclusión financiera, acaba de entrar en vigor la ley que recibe precisamente el nombre de Ley de Inclusión Financiera. Aunque por su nombre pudiera parecer que tiene un alcance mucho mayor, su principal aportación es la creación de las Sociedades Especializadas en Depósitos y Pagos Electrónicos (Sedpe). Estas entidades tendrán autorizada la captación de recursos, aunque no podrán conceder créditos. Sus principales servicios serán la realización de giros, pagos y transferencias. Podrán emitir tarjetas de débito. Las principales novedades de estas entidades serán una necesidad de capital muy inferior a la necesaria para abrir un banco (tan solo el equivalente a unos 2,7 millones de US$), y que quedan exentos del pago del 4 por mil al que están sujetas las entidades financieras tradicionales. Los depósitos estarán garantizados por Fondo de Garantías de Instituciones Financieras (Fogafín). La apertura de cuentas se podrá hacer con apenas tres datos básicos.

Comments

Estrategias de Inclusión financiera

En México al igual que en las otras ciudades, surgen cada vez más instrumentos de inclusión financiera que están acompañados de estrategias que enseñan a la población a manejar sus finanzas personales. A partir de la aprobación de la reforma fiscal del año pasado, la población tiene mayor posibilidad de obtener créditos a tasas más accesibles. Uno de los grandes retos es la implementación de estrategias de acceso fácil a la población como se hace en otras ciudades a través de numerosas compañías de telefonía móvil que vinculan la banca personal. En este sentido la población tendría mayor acceso y conocimiento de sus finanzas personales.

Delhi article- Financial inclusion and education

Priyanka, it is a great article. Actually introducing financial sustainability using an educational approach as you mentioned on the experience of some organizations including Sanchayan Society is really very interesting and inspiring. Education has been always proved to be a very effective way and influential method to create a change and an impact for the whole socity. I wonder, how such organizations as Sanchayan Society found the youth's encouragement and join percentage? Is it easy to get such unprivileged youth interested in those educational initiatives to make the awareness and education as one of their priorities? Also, how the government encourages those NGOs who are working to promote financial "awareness"?

Great article!!!

"FUN" Financial Literacy Program

Thanks for your kind comment, Shaima. Sanchayan has active tie ups with private and government schools as well as NGOs. The "FUN" Financial Literacy Program comprises of games, role plays, stories and videos to make the workshop highly interactive and participative. Its subdivided into two programs. Paid workshops for students and teachers of private schools. The focus is to not cover details but ignite young minds to learn and increase their knowledge. The revenue generated from these workshops is used to provide free workshops at government schools. For those who are not part of formal education system, they reach through orphanages, NGOs and institutions across the country. In both cases, the workshops are longer than one for private schools with focus on the basics of savings, budgeting, banking etc. I am not sure of their current status, but they have been supported by the Project Financial Literacy (Reserve Bank of India) and Securities and Exchange Board of India as well as Organization for Economic Cooperation and Development.

We have renamed our verticals

We have renamed our verticals and the children & youth program is called MoneySmart. If you would like more info then pls write to us. Thanks for covering our work.

The Voice of the Poor

The woes of the poor on the financial inclusion matrix is more than words can describe. In the city space of Accra, the poor is the least considered in the service of banking. Banking services are mostly geared towards the elites of the city with captions such as Royal Banking, Special current account and Premium bankers. All the demands of these services are and will never be met by the poor. Where on earth can the poor get collateral to support loan application to have access to credit to expand business? Who in the bank can escort the poor beyond the counter to be attended to when all he/she has is a little savings which is too insignificant to be noticed. Banks in the city space must come out with strategies to support the growth and productivity of the marginalised poor in the city.

Mobile Money: Cautionary Tales

It's interesting to read the reasons Nora presents for mobile banking not being taken up as widely as expected in Lilongwe. It's an obvious stretch to link up mobile payments to fast food chains and other formal institutions that are outside the purview of the urban poor. It does seem to me that there is great potential for mobile banking for this demographic, particularly for the urban-rural transactions, but others usages seem like they could be trickier. For example, Hilary mentions a program in Nairobi where quick, small loans can be granted simply through mobiles. The mobile loans, however, skip key steps that Priyanka and others mention about the need for financial literacy and awareness--perhaps more important than efficiency of a mobile loan. Microfinance succeeded in such a big way because there was not only a group commitment but hands-on weekly check-ins from loan officers who would be sure the recipients were on track. For mobile banking to truly realize its potential among the urban poor, there needs to be a balance between the convenience of the technology and the hands-on services required to ensure that the loans are accessed and used with thoughtful planning.

Mobile technology

I couldn't agree more Carlin, financial and technology literacy needs to be an important aspect of programs targeting financial inclusion especially as most efforts often involve some technological innovation/breakthrough. I found it really interesting that majority of the articles touched on mobile money, and some will argue that by the very virtue of technology being involved, the programs are exclusive as know-how, access and affordability of that technology is required. These programs cannot go on without proper education.

Education about financial and technology literacy is also important as it seems it would be key in solving access to credit issues, mobile technology is not leaping in the south, and as service providers are now required to register users (at least in Nigeria), I imagine a form of database linked to cellular registration will inform mobile loan applications in the future. Programs like the mobile investment in Nairobi give hope to effective use of mobile technology, provided all other aspects such as access and know-how are considered.

Empowering the Individual

Hey Carlin, I agree with you completely that increased financial literacy training is critical to individuals seeking micro-credit loans and access to non-traditional credit markets. I think that for some however, access to cooperative credit schemes have declined in importance due to a number of factors. In Kenya for example, the difficulty for highly impoverished urban households may be that such schemes, where they do exist, still crowd out members for numerous reason and/or may not be readily accessible within an individuals economic geography. In such cases, the micro lending mobile scheme developed, such as the one I covered in my article developed by M-Pesa, is one mechanism for short-term emergency lending that still has built in protocol for repayment and savings. Though the threshold appears low, 20Ksh/day, for many individuals this is still a significant saving investment/decision. It is important that the real need for education not be overshadowed by the realities of lack of access due to increased demand for these trainings and realities faced by individuals living and operating across informal settlements. Understanding that opportunity and access continue to be constrained for many provides a justification for innovative mobile lending, especially when built on years of successful experiences with mobile money platforms that the Kenyan market has truly been at the forefront of developing. For some as well the economic cost of attending regular meetings may not be realistic, which opens up the possibility for eLearning opportunities which might be better suited towards a highly mobile market such as Kenya while not as ideal for another setting. Critical to obtaining sustainable human development is adequate accounting for the realities of local context and unique barriers faced by different population segments.

On the need for a holistic approach

The articles this month highlight how complex the issue of finance is. In my article I mention how, at a minimum, mobile money in Malawi can give the poor an opportunity to store money safely (on their mobile money account vs under their mattress), Tariq talks about the importance to promote savings over loans in South Africa, Hilary discusses new ways of accessing loans on your phone in Kenya, Priyanka talks about financial literacy skills, and Wura describes an expansion of formal financial services to the poor. What seems to be missing to me are examples of instutitions/organisations doing all of the above. Sure, piecemeal and step-by-step approaches may bring us closer to financial inclusion of the urban poor, but there is a need for all aspects of finance to be a reached in order for the poor to truly benefit from financial inclusion. After all, that’s what financial inclusion really means, to be able to save, borrow, invest, keep your funds securely and make secure transactions. So far, it seems we're achieving either one or the other.

Fighting Poverty & Gender Inequality in Cali

Jorge, I really enjoyed your article this week on the importance of considering and including gender in financial institutions development of targeted poverty alleviation programming. It is especially encouraging to read of organizations such as the Banco WWB that began as relatively radical approaches over three decades ago, to address development and economic security for low-income women and have not only sustained over the years but continued to achieve impactful programming and outcomes for women. As the link between gender and development continues to be highlighted by multi-lateral institutions, development agencies and community-based organizations it is important that successful initiatives continue to be highlighted in forums like this one. Thanks for this article!

youth empowerment

Hi Carlin, i have similar question as aura has raised and i think you presented an interesting case where the government acknowledged the youth and decided to capacitate them. I am also wondering the political process behind this policy and maybe further question is about what to do with youth that have been provided with skills? are they directly working or what kind of policy follows? because indonesia has similar problem in demographic surplus and there has been little effort to empower youth

Add new comment